By Robert Homans

The Equipment Leasing and Finance Foundation (ELFF) held a

briefing highlighted significant changes between 2007 and 2012, in the

use of all types of financing to acquire equipment and software,

especially the increased use of short-term credit to acquire equipment

among businesses of all sizes, including both credit lines and credit

cards, and the decreased volume of cash purchases.

Over this same period banks increased their share of the

equipment finance market, but mostly at the expense of captives rather

than at the expense of independent finance companies. At the same time

credit conditions are improving and demand for credit is growing.

Overlaying these trends is an economy that in 2012 is growing slowly,

if at all, but is expected to accelerate in the latter half of 2013.

Finally, there is the dampening effect of the “fiscal cliff”

on equipment acquisition decisions, which definitely affected the

results.

Overall Economic Activity –-

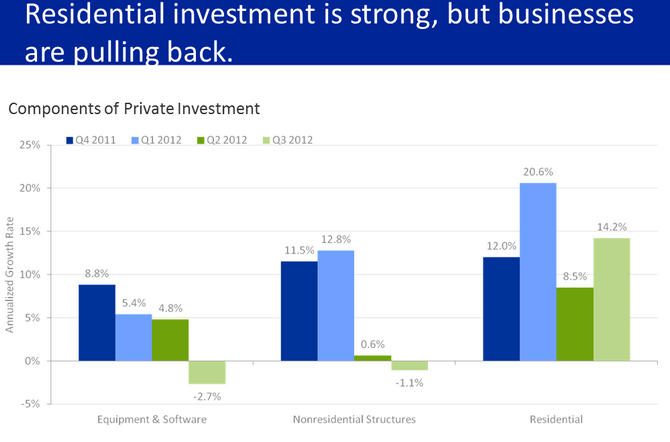

The briefers believe that GDP would grow by approximately 2.4%

in 2013, with accelerated growth (3%) in the 2nd half of 2013. The

major factor contributing to increased growth is residential housing,

which the briefers expected to add approximately 1% to annual GDP

growth, and 20 – 30,000 jobs/month, over the next several years.

Other factors expected to contribute to economic growth in 2013 include

increased business investment and consumer spending.

The chart above illustrates the influence on residential

investment on the growth in the overall economy, showing quarterly

changes for the most recent 4 Quarters.

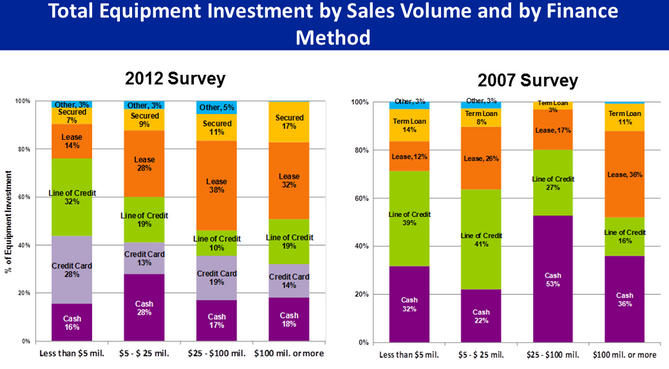

This table is yet another confirmation of the desire among businesses, over the past several years, to conserve cash.

One of the briefers commented that he expected the effect of

no agreement on the budget, in terms of GDP growth, to be “more of a

slope than a cliff.” The actual effect of the “Fiscal Cliff,” in

terms of Dollars, is approximately 4% of GDP, or $600 Billion against a

GDP of approximately $15 Trillion.

Use of Financing in Acquisition of Equipment & Software –-

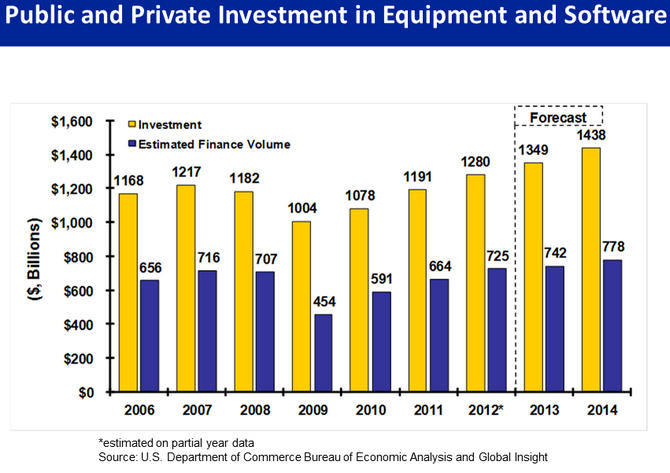

In 2012 the rate of growth in the use of financing, including

leasing, to acquire equipment and software, exceeded the overall rate

of growth of equipment and software acquisition by a significant

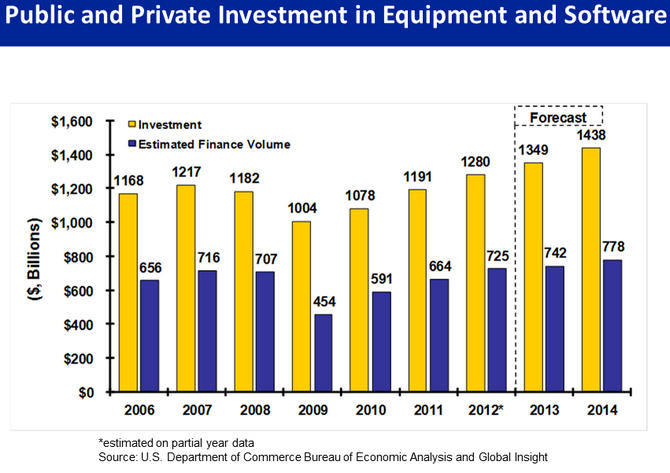

margin. The bar chart below shows that 2012 will see public and

private investment in equipment and software grow by approximately

7.5%, compared to 2011. The use of all types of financing to acquire

equipment and software grow by approximately 9.2% during the same

period. 2012 will the first year where the use of all types of

financing, including leasing, is expected to exceed levels achieved in

2008. However, the use of all types of financing to acquire

equipment and software, as a percentage of total acquisitions, is still

lower than it was in 2008, 56.5% in 2012 compared to 59.8% in 2008.

This compares to 45.2% in 2009, at the depths of the Financial

Crisis, and supports the contention of the briefers that credit

conditions are improving.

In 2012 76% of all businesses used borrowed money on some

basis, mostly by larger companies. In 2012 86% of all business with

over $25 million in annual sales used borrowed money, compared to 46%

of small businesses (less than $5 million in annual sales).

The data shows that small businesses are making increased use

of short-term financing to acquire equipment, including both lines of

credit and credit cards. The chart above shows that during 2007

small businesses used lines of credit to acquire equipment and software

only 39% of the time, compared to 60% of the time in 2012 and of this,

approximately half was through use of credit cards. During the

same period, the use of short-term financing by large businesses (over

$100 million in annual sales) more than doubled, with a significant

portion through use of credit cards.

Throughout this same period both large and small businesses

decreased cash purchases of equipment and software. The data shows

this trend is especially true of businesses with annual revenues of

between $25 and $100 million, where use of cash to acquire equipment

and software decreased by approximately 2/3rds. This may be one

illustration of the substantial cash build-up by private industry in

the years since 2007 that has been amply reported elsewhere. (1)

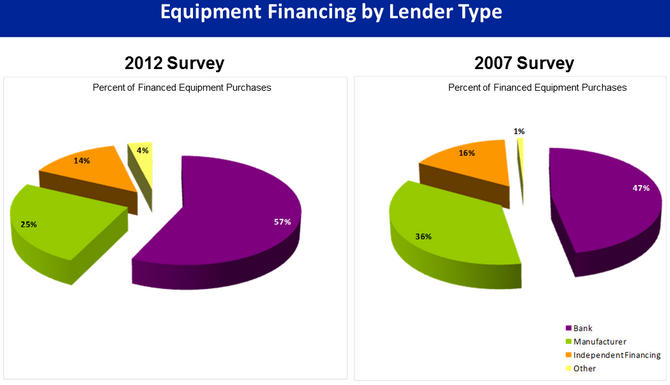

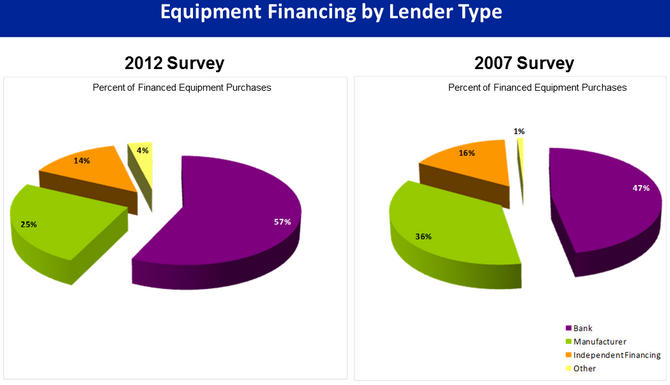

The chart above shows that between 2007 and 2012 banks

increased their share of total equipment finance volume, from 47% to

57%. This increase came mostly at the expense of manufacturers and,

to a lesser extent, from independent finance companies. The

explanation at the briefing centered on banks’ lower cost of funds and

the relative success of larger companies, who are likely better

credits, in accessing borrowed funds. An additional explanation may

also include the divestment by automobile manufacturers of their

finance arms in 2008 and 2009, with Ally Capital moving from being a

captive (formerly GMAC) to an independent finance company, the Chapter

11 bankruptcy of CIT Group in 2009 and decreased activity by captives

in general during this period.

According to the ELFF briefers credit conditions are

improving, especially on commercial and industrial (“C&I”) loans.

C&I loans are up 3% in the last 3 months and 13% year-over-year,

however leasing volume during this period has decreased slightly.

Part of the reason is illustrated in the table above, by increased use

of short-term credit, both lines of credit and credit cards, to acquire

equipment. Loan delinquencies are at a 3-year low.

The briefers said that, overall, businesses remain cautious

about making future investments in plant and equipment, influenced

partly by the uncertainty over the budget negotiations in Washington,

DC, referred to as the “Fiscal Cliff.” Assuming that agreement is

reached, the prediction at the briefing was that it would take at least

6 months for most businesses to act on planned investments that have

been put on hold pending resolution of the negotiations, thus the

positive effect of an agreement will likely not be felt until the 2nd

Half of 2013.

Sectoral Trends –-

The briefers stated that investment in construction equipment

is, by far, the strongest sector, and must of the acquisition of

construction equipment is being driven by construction in residential

housing. This is expected to continue into 2013 with expected

increases of 15% or higher.

Overall predictions for 2013,

as well as positive and negative factors effecting the predictions, for

other equipment sectors that concern finance and leasing, are as

follows:

Agricultural Equipment –

Overall – Negative Growth (0 to -10%)

Positive Factors - High commodity prices

Exports

High land prices

Negative Factors –

Uncertainty over renewal of the Farm Bill & crop subsidies

Reduction of ethanol subsidies

Effects of 2012 drought

Computers & Software –

Overall – Below Average Growth (1 – 3%)

Positive Factors - Obsolescence

Introduction of new operating systems (Windows 8) using

touch screen interface

Negative Factors -

Uncertainty over “Fiscal Cliff”

Industrial Equipment –

Overall – Average Growth (3 – 6%)

Positive Factors - Obsolescence

Lower natural gas prices causing manufacturing to return to US (beyond 2013)

Negative Factors

- Capacity utilization overhang

Uncertainty over “Fiscal Cliff”

Medical Equipment –

Overall – Slow to No Growth (-2% - 2%)

Positive Factors - Obsolescence

Approximately 30 million individuals obtaining insurance coverage under the Affordable Care Act

Negative Factor

- Proposed medical device tax under the Affordable Care Act.

Transportation Equipment –

Average Growth (8-12%)

Positive Factors –Obsolescence

Changes in emission & noise standards

Introduction of new equipment (especially aircraft)

Negative Factors

- Change in accounting treatment for operating leases

Another issue, raised in the briefing was the effect of the possible end of bonus depreciation.

The person responding to this question said that he didn’t think

that the end of bonus depreciation would have much, if any, effect on

equipment purchase decisions most of which, he believed, were driven by

other factors such as availability of credit, expansion needs, and

other factors.

Summary –

- For most businesses, cash is still "king"

- Some businesses may encounter working capital

constraints, from using short-term financing to acquire equipment

and software, especially if GDP grows faster than expected

- “Fiscal Cliff” is creating uncertainty that will continue well into 2013

- In 2013, housing is the place to be