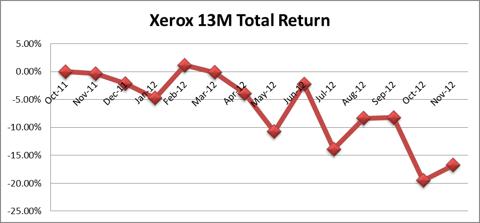

We have been following Xerox Corporation (XRX) since the middle of January largely because David Einhorn (Greenlight Capital) had purchased 17M shares of the company in Q4 2011. We have stepped up our coverage of Xerox in October as the company's shares were trading at a 30% discount to book value. However, we are most certainly aware that just because a company's shares are trading at a low price to book value does not automatically make it a great value.

When we first started following Xerox, the company's shares were trading at a 5% discount to book in the middle of January. The primary reason why its price to book discount narrowed to a small 5% discount to book was due to investor enthusiasm surrounding David Einhorn's stake in Xerox through his Greenlight Capital hedge fund. Although Xerox is cheap by many traditional measures such as free cash flow yield, PE ratio and price to book, we have demurred from taking a position in the company because we have been concerned that it was a value trap. We previously covered why we saw it to be a value and in this report we will analyze why we think it may be a value trap.

Source: Morningstar Direct

Why Xerox May be a Value Trap:

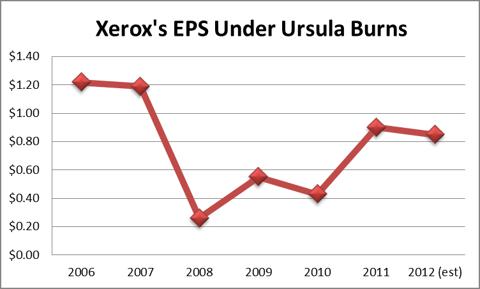

Xerox's CEO Ursula Burns: Ursula Burns has been President or CEO of Xerox since April 2007 and during that time frame, Xerox's stock has registered a negative total return of 57%. Xerox earned $1.22 in reported EPS in 2006, the year before Burns became President. Despite spending over $4.1B in acquisitions and $2.6B on share repurchases, Xerox's Adjusted EPS is expected to be $1.08 and its reported EPS is expected to be $.85 after accounting for acquisition related intangible amortization and restructuring charges. Part of our apprehensiveness with regards to jumping into Xerox alongside Greenlight Capital is that we were concerned that the weak macroeconomic environment was an excuse for poor management and execution issues. We disagree with Oscar Schafer that Ursula Burns is a "tough, no-nonsense CEO" based on the performance of Xerox during her leadership of the company. We believe in calling things as we see them and we think it's appropriate to consider the poor results we have seen under Ursula Burns when evaluating her tenure.

Source: Morningstar Direct and Xerox's Most Recent Guidance

Xerox's Quality of EPS: 2006 was the last year before Ursula Burns was CEO or President and it generated $1.22 in GAAP EPS and $1.05 in Adjusted EPS. 2006 saw its GAAP EPS exceed its adjusted EPS as $500M in Tax Audit Benefits were partially offset by $254M in restructuring charges and $68M in litigation expenses. The company had no adjustments to EPS for FY 2007 and it reported $1.19 in EPS for the year. Unfortunately for Xerox, its EPS from 2008 to present has seen a significant level of adjustments to EPS in each year. 2009 was the year with the lowest level of adjustments ($.15/share) and 2008 was the highest ($.84/share). Of Xerox's $4.90 in EPS from 2008 to 2012, nearly $2/share was clawed back for its never-ending "non-recurring adjustment charges to EPS". 2012 promises to be no different as it will see about $.25 in non-recurring charges for restructuring and amortization of acquisition related intangible assets. At least Xerox's management is only targeting $.15/share in adjustments in 2013 primarily due to amortization of acquisition related intangibles.

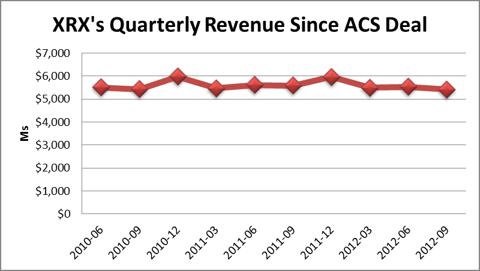

Xerox's Revenue Growth: Xerox's year-over-year revenue growth has never exceeded 3% on a pro forma basis in any quarter since its 2010 acquisition of Affiliated Computer Services. That's not to say that the ACS deal was a deal from hell. In our opinion, we believe that deal was a lifeline for Xerox as ACS's strength in IT Services has offset the weak performance from legacy Xerox operations. Xerox grew its services related revenues by nearly 5% year-over-year in Q3 2012 even though it was faced with significant global macroeconomic headwinds. Unfortunately for Xerox, this was not enough to offset a 10% revenue decline from its products and supplies as well as the associated technical service, support and financing of its products.

Source: Morningstar Direct

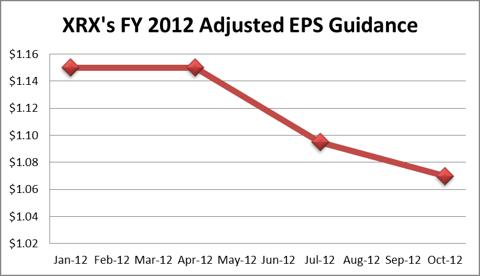

Xerox's Guidance: Even though we have not taken a position in Xerox, we believe that covering the company is comparable to water torture. The reason why we feel this way about Xerox isn't because the stock has gone down by 22% since we began increasing our research resources on it, but because the company has been steadily reporting guidance that has been soft and sour. We think it is becoming a trend on Xerox's part to meet consensus adjusted estimates and to reduce forward guidance and also to announce "non-recurring restructuring charges" that are "excluded from adjusted EPS guidance". At the beginning of 2012, Xerox issued adjusted EPS guidance of $1.12-$1.18. As of its most recent quarter, the company has once again revised its guidance down to a range of $1.07-$1.09, down from $1.07-$1.12 in Q2 2012. Xerox recently announced guidance of $1.09-$1.15 for FY 2013, which was 3% lower than its original guidance for FY 2012.

Source: Xerox's 2012 Earnings Reports

Conclusion

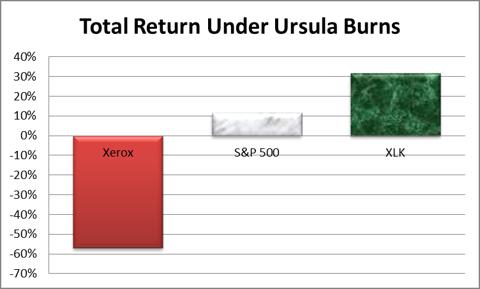

In conclusion, we have taken a fair and balanced approach to analyzing Xerox. We previously evaluated what we liked about Xerox and we have now analyzed what we don't like about Xerox. One thing that Xerox needs to do in order to enable it to unlock shareholder value is replace Ursula Burns with an executive who knows what he or she is doing. Burns has been President or CEO for five going on six years and has been CEO for more than three years. During Burns' tenure as President or CEO of Xerox, the company's shares have declined by 57% while the S&P 500 has recovered its financial crisis losses and generated a total return of 12% during that time. Xerox's 57% negative total return paled in comparison to the 32% positive total return generated by the S&P SPDR Technology ETF (XLK). Although we are pleased to see Xerox make overtures to shareholders by increasing the dividend and share repurchase authorization, we are getting irritated with the sour notes that we've been hearing from management and we question whether Xerox has the right management team to enable it to unlock shareholder value.

Source: Morningstar Direct

Additional disclosure: Additional disclosure: This article was written by an analyst at Saibus Research. Saibus Research has not received compensation directly or indirectly for expressing the recommendation in this article. We have no business relationship with any company whose stock is mentioned in this article. Under no circumstances must this report be considered an offer to buy, sell, subscribe for or trade securities or other instruments.